Product Buckets

Loading articles...

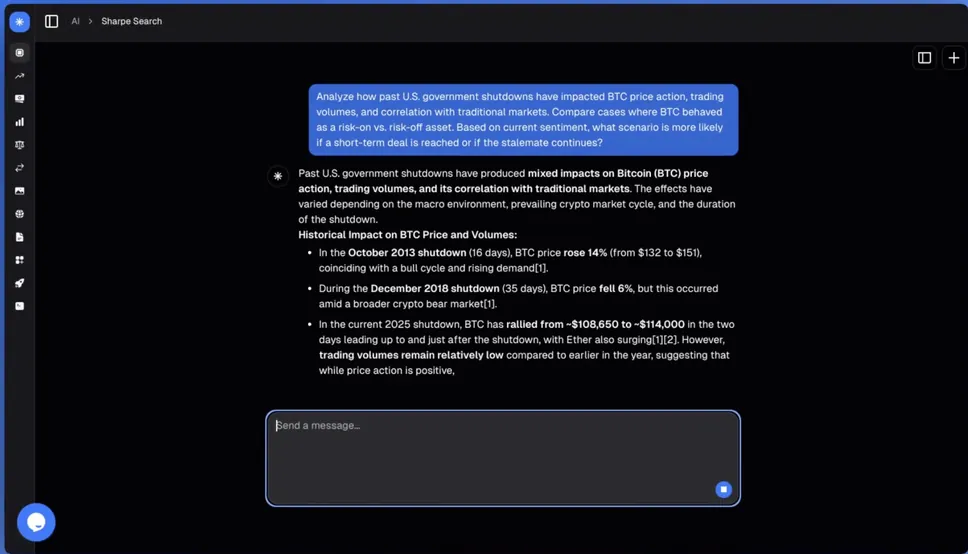

Expert insights on crypto trading, DeFi strategies, and market analysis powered by AI

Sharpe Buyback revolutionizes how crypto projects buy back tokens. Learn how this "Reverse Launchpad" eliminates bot advantages, slippage, and opacity while ensuring fair, pro-rata distribution for all holders.

Master the market with the Sharpe AI Crypto Screener. Learn how to combine technical and fundamental filters to discover undervalued assets.

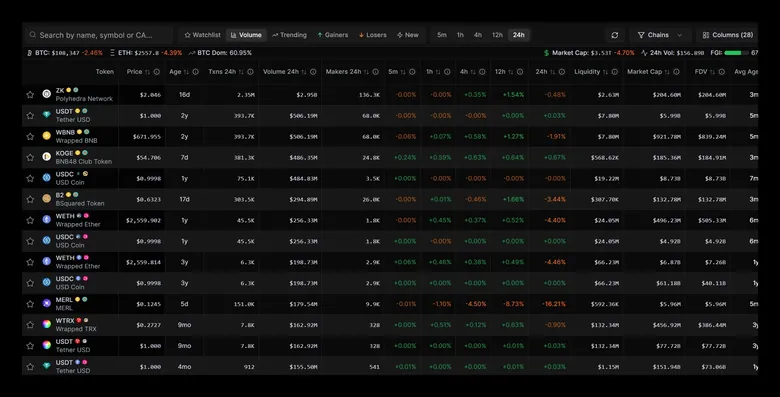

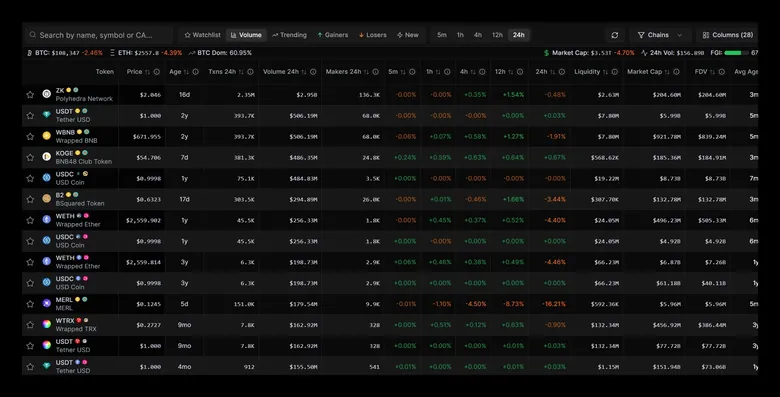

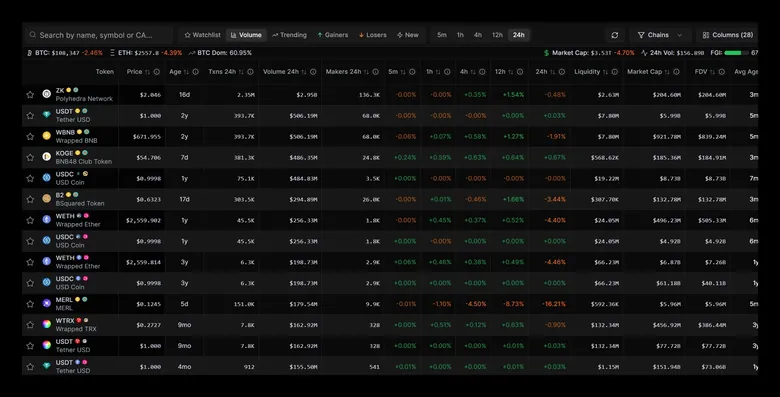

Sharpe Dexscan provides real-time decentralized exchange analytics. Learn how to track liquidity, monitor whale movements, and analyze price action across 60+ blockchains.

Sharpe AI is an institutional-grade crypto superApp offering consolidated tools for DeFi. Learn how it integrates DEX screening, wallet tracking, and AI predictions into one terminal.

47 articles found

Sharpe Buyback revolutionizes how crypto projects buy back tokens. Learn how this "Reverse Launchpad" eliminates bot advantages, slippage, and opacity while ensuring fair, pro-rata distribution for all holders.

Master the market with the Sharpe AI Crypto Screener. Learn how to combine technical and fundamental filters to discover undervalued assets.

Sharpe Dexscan provides real-time decentralized exchange analytics. Learn how to track liquidity, monitor whale movements, and analyze price action across 60+ blockchains.

Sharpe AI is an institutional-grade crypto superApp offering consolidated tools for DeFi. Learn how it integrates DEX screening, wallet tracking, and AI predictions into one terminal.

Build crypto funding rate prediction models with clean data, validation pipelines, and monitoring.

Stand up crypto financing desk operations with processes for lending, collateral, and compliance.

Reserve liquidity precisely with a crypto fill or kill order, covering venue quirks, size calibration, and failover routes.

Use a crypto Fibonacci retracement strategy to plan pullback entries, stop placement, and risk controls.

Compare crypto exchanges with a checklist covering regulation, fees, liquidity, security, and support.

Trade crypto event driven basis with catalyst calendars, hedging plans, and treasury alignment.

Trade spot and futures ETFs with crypto ETF trading basics covering flows, premiums, and hedging.

Trade crypto ETF creation redemption arbitrage with custody logistics, borrow planning, and hedge automation.

Build a crypto ETF basis monitoring dashboard showing premiums, borrow, and liquidity signals for AP desks.

Build a crypto dollar cost averaging strategy: schedule buys, pick assets, manage risk, and track performance.

Build long-term exposure with a crypto dollar cost averaging strategy that covers cadence, custody, and review routines.

Trade crypto dispersion with basket options, vol analytics, and disciplined hedging workflows.

Optimize crypto derivatives margin usage with portfolio offsets, automation, and risk limits.

Protect crypto DeFi yield portfolios with hedges, automation, and risk dashboards.

Build a disciplined crypto day trading strategy with session planning, execution frameworks, and end-of-day reviews.

Trade crypto cross currency basis spreads with FX hedges, funding data, and robust settlement workflows.

Operate crypto cross chain market making with routing tech, treasury logistics, and risk controls.

Establish crypto counterparty risk controls with monitoring, legal playbooks, and diversified exposure.

Follow pros safely with a crypto copy trading strategy that emphasizes due diligence, sizing caps, and performance audits.

Master crypto cold storage: hardware, air-gapped setups, backup workflows, and recovery drills for long-term security.

Learn how pro desks run crypto cash and carry arbitrage with funding math, settlement workflows, Reddit intel, and risk controls.

Time volatility expansions with a crypto breakout trading strategy using confirmation filters and risk controls.

Optimize crypto borrow desk operations with intake workflows, inventory tracking, and compliance.

Trade volatility compressions and expansions with a crypto Bollinger Bands trading plan and disciplined risk work.

Deep guide to crypto basis trading with execution flows, data signals, Reddit intel, and risk controls for professional desks.

Automate crypto basis trades with execution bots, risk guardrails, and treasury workflows. Scale market-neutral carry capture without human latency through professional automation.

Run crypto AMM delta neutral strategy with hedges, automation, and robust risk tracking. Earn AMM fees while neutralizing price risk through professional DeFi liquidity management.

Spin up crypto algorithmic trading basics including data pipelines, execution, and monitoring. Build systematic strategies with disciplined engineering and risk management.

Coordinate cross exchange crypto arbitrage with capital staging, transfer automation, and risk management. Learn how professional desks capture venue-to-venue price gaps without net exposure.

Learn blockchain explorer basics for tracking transactions, verifying addresses, and auditing smart contract activity. Master on-chain transparency tools for secure crypto operations.

Spot-perpetual arbitrage exploits price differences between spot and perpetual futures markets, generating 15-40% APY through funding rate collection and basis spread capture.

Delta neutral trading eliminates directional risk by balancing long and short positions, generating 8-30% annually from volatility, time decay, or funding rates without predicting price direction.

Statistical arbitrage crypto generates 12-25% annually through market-neutral pairs trading strategies that exploit mean-reverting price relationships between correlated assets.

DEX arbitrage exploits price differences between decentralized exchanges. Learn flash loan strategies, gas optimization, and MEV protection to profit from AMM inefficiencies.

Crypto exchange arbitrage profits from price differences between exchanges, typically 0.5-3% per trade. Learn how to exploit cross-exchange spreads.

Triangular arbitrage crypto generates 0.1-0.5% profits per trade by exploiting price imbalances in three-currency loops on exchanges.

Funding rate arbitrage generates 10-40% APY through perpetual futures. Learn how to collect funding payments every 8 hours with market-neutral positions.

Basis trading crypto generates 5-20% annual returns through cash-carry arbitrage. Learn how to profit from spot-futures price differences with minimal risk.

Manual analysis takes 11-19 hours. MCP middleware enables AI to detect liquidity manipulation, ownership concentration, and 5 other critical red flags in <11 minutes through structured blockchain data access.

General LLMs fail at crypto due to data sparsity and no real-time access. Learn how MCP middleware like Hiveintelligence.xyz enables specialized search.

Data platforms show numbers but cannot synthesize them. Learn how MCP middleware like Hiveintelligence.xyz enables synthesis, correlation, and reasoning beyond raw metrics.

Learn how to identify high-potential altcoins using advanced DEX analytics. Master on-chain metrics, liquidity analysis, and smart money tracking to find profitable investment opportunities.

Find the best crypto search engine for blockchain research. Compare AI-powered tools, traditional databases, and discover what makes crypto search actually useful.