Finding Best Altcoins to Invest: A Complete Guide to Using DEX Analytics

Learn how to identify high-potential altcoins using advanced DEX analytics. Master on-chain metrics, liquidity analysis, and smart money tracking to find profitable investment opportunities.

Finding Best Altcoins to Invest: A Complete Guide to Using DEX Analytics

In the fast-paced world of cryptocurrency trading, finding the next 10x altcoin before it explodes requires more than luck: it demands data, strategy, and the right tools. While centralized exchanges show you what's already popular, DEX analytics reveal what's actually happening on-chain, where smart money moves first and real opportunities emerge.

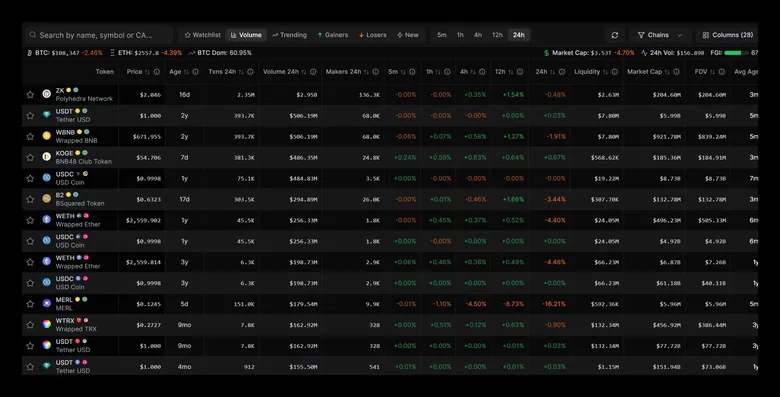

This guide will show you exactly how to use Sharpe AI's DexScan tool to identify high-potential altcoins before they hit mainstream attention. You'll learn which metrics actually matter, how to spot early accumulation patterns, and when to enter positions for maximum profit potential.

Why DEX Analytics Beat Traditional Research for Finding Altcoins

Traditional crypto research relies on lagging indicators: social media hype, exchange listings, and price action that's already happened. By the time a token trends on Twitter or gets listed on Binance, smart money has already accumulated and retail is providing exit liquidity.

DEX analytics flip this script entirely. You're watching:

- Real-time liquidity flows - See money entering pools before price moves

- Wallet behavior patterns - Track what experienced traders are accumulating

- On-chain transaction data - Identify unusual activity patterns early

- Smart contract interactions - Spot new token launches and migrations instantly

The key advantage: DEX data can't be faked. Unlike social metrics or exchange volume (which can be wash traded), on-chain transactions are immutable and transparent. When you see 50 new wallets accumulating a token with increasing liquidity, that's real activity you can verify on the blockchain.

Essential Metrics for Identifying High-Potential Altcoins

Not all metrics are created equal. Here's what actually matters when hunting for the next big altcoin using DexScan:

1. Liquidity Growth Rate

What to look for: Steady liquidity increases over 7-30 days

Liquidity is the lifeblood of any token. Rising liquidity means:

- Market makers are confident enough to provide capital

- Less slippage for larger trades

- Lower risk of rug pulls (though not zero)

Red flag: Sudden liquidity spikes followed by plateaus often indicate artificial pumps.

Pro tip: Compare liquidity growth to price action. If liquidity is growing faster than price, it's a bullish accumulation signal.

2. Holder Distribution Metrics

Key metrics to monitor:

- Nakamoto Coefficient: Higher values (>50) indicate better decentralization

- Gini Coefficient: Lower values (<0.8) suggest fairer token distribution

- Real Holders vs Total Holders: Filters out dust wallets and bots

What makes a good distribution:

- Top 10 wallets hold less than 40% of supply

- Growing number of unique holders daily

- Average wallet age increasing (indicates holding, not flipping)

3. Smart Money Indicators

Wallet Age Analysis:

- Average Wallet Age: Older average age = experienced traders accumulating

- Age Standard Deviation: Low deviation means consistent holder base

- Wallets <1D and <7D: New wallet percentage - too high (>30%) might indicate bot activity

Accumulation Patterns: Look for tokens showing:

- Consistent daily buyer/seller ratio above 1.2

- Increasing transaction count with stable or rising price

- Growing maker count (unique liquidity providers)

4. Technical Analysis Rating

DexScan's TA Rating combines multiple indicators:

- V.Bullish/Bullish: Strong technical setup for entry

- HODL: Consolidation phase, watch for breakout

- Bearish/V.Bearish: Avoid or wait for reversal signals

This automated analysis saves hours of chart reading and helps filter opportunities quickly.

5. Risk-Adjusted Returns

Critical metrics:

- Volatility/Reward Ratio: Lower is better (aim for <2)

- Sortino Ratio: Higher values indicate better downside risk management

- BTC Correlation (β): Low correlation (<0.5) provides portfolio diversification

These metrics help you find tokens with asymmetric risk/reward profiles, essential for altcoin investing.

Step-by-Step Process to Find Investment Opportunities

Step 1: Set Your Initial Filters

Start with these baseline filters in DexScan:

- Liquidity: Minimum $50,000 (ensures basic tradability)

- Age: 7-90 days (not too new, not too old)

- Market Cap: $100K - $10M (small enough for growth, large enough for stability)

- Volume 24H: Minimum $10,000 (confirms active trading)

Step 2: Apply Smart Money Filters

Narrow down to tokens smart money is accumulating:

- Holders: Minimum 100 (real community forming)

- Real Holders: At least 50% of total holders

- Buyer/Seller Ratio: Above 1.1 (more buyers than sellers)

- Average Wallet Age: Above 14 days (not just launch hype)

Step 3: Check Distribution Health

For each remaining token, verify:

- Gini Coefficient: Below 0.85

- Nakamoto Coefficient: Above 30

- Top 10 Holders: Own less than 50% combined

This eliminates heavily concentrated tokens that pose rug pull risks.

Step 4: Analyze Price Action and Momentum

Sort by different timeframes to identify patterns:

- 5M/1H Performance: Quick momentum check

- 24H Performance: Daily trend confirmation

- 7D Trend: Look for steady growth or consolidation after growth

Golden Pattern: Flat or slightly down on 5M/1H, but up 10-30% on 24H/7D with increasing volume.

Step 5: Deep Dive on Top Candidates

For your top 5-10 tokens, conduct deeper analysis:

- Check the Chart: Click on the token to view detailed price action

- Verify Liquidity Depth: Ensure you can enter/exit your position size

- Review Transaction History: Look for organic trading patterns

- Research Fundamentals: Visit project website and documentation

- Check Social Presence: Verify team activity and community engagement

Step 6: Risk Management and Entry Strategy

Position Sizing:

- Never invest more than 1-2% of portfolio in a single small-cap altcoin

- Diversify across 5-10 positions for better risk distribution

- Keep 50% in stablecoins for opportunities and risk management

Entry Tactics:

- DCA Entry: Split your position into 3-4 entries over several days

- Liquidity Entry: Place orders during high liquidity periods (usually US market hours)

- Support Entry: Buy near established support levels identified in charts

Exit Planning:

- Set initial profit targets at 2x, 5x, and 10x

- Take 20% profit at each target

- Keep moon bag (20%) for potential massive gains

- Set stop loss at -30% to -50% depending on risk tolerance

Advanced Strategies for Experienced Traders

1. Chain Arbitrage Opportunities

Use DexScan's multi-chain view to identify:

- Same token trading at different prices on different chains

- New chain deployments of successful tokens

- Chain-specific trends (e.g., gaming tokens on specific L2s)

Filter by chain and compare similar tokens across ecosystems for relative value plays.

2. Correlation Trading

Use the BTC Correlation (β) metric to build portfolios:

- High correlation (>0.8): Moves with Bitcoin, safer during bull runs

- Low correlation (<0.3): Independent price action, good for diversification

- Negative correlation: Rare but valuable for hedging

Combine high and low correlation tokens for balanced exposure.

3. Accumulation Phase Identification

The "ACCUM" status in DexScan identifies tokens in accumulation phases. These often precede major moves:

- Early Accumulation: Smart money entering, price stable

- Mid Accumulation: Holder count growing, slight price increase

- Late Accumulation: Momentum building, breakout imminent

Best risk/reward comes from entering during early to mid-accumulation.

4. Volume Analysis Patterns

Beyond simple volume metrics, look for:

- Volume Precedes Price: Increasing volume with stable price = accumulation

- Maker Growth: More liquidity providers joining = confidence increasing

- Transaction Size Trends: Larger average transactions = institutional interest

5. New Token Launch Strategy

Monitor tokens less than 24 hours old:

- Sort by Age (ascending)

- Filter for minimum $25K liquidity

- Check if top wallets are time-locked

- Verify contract is verified and renounced

- Enter small positions in promising launches

- Exit quickly (within hours/days) with 2-5x gains

Warning: Extremely high risk. Only for experienced traders with disposable capital.

Common Pitfalls to Avoid

1. Ignoring Liquidity Depth

A token might show $1M liquidity, but if it's all in one range, large trades will cause massive slippage. Always check the liquidity distribution.

2. Chasing Green Candles

If a token is up 100% in 24 hours, you're likely too late. Look for consolidation after growth, not parabolic moves.

3. Overlooking Holder Concentration

Even with 1000 holders, if one wallet owns 30%, you're at risk of massive dumps. Always check distribution metrics.

4. Falling for Vanity Metrics

High holder count means nothing if they're all dust wallets. Focus on "Real Holders" and wallet age metrics.

5. Neglecting Risk Management

The best altcoin strategy fails without proper position sizing. Never bet more than you can afford to lose completely.

Real-World Example: Identifying a Winner

Let's walk through a real example using DexScan:

Initial Scan:

- Filter: Liquidity >$100K, Age 14-30 days, Ethereum chain

- Sort by: 7D performance

- Result: 47 tokens identified

Smart Money Filter:

- Real Holders >100, Wallet Age Avg >21 days

- Result: 12 tokens remaining

Distribution Check:

- Gini <0.8, Nakamoto >40

- Result: 5 tokens qualify

Momentum Analysis:

- Positive 24H and 7D, but not parabolic (< 50% gains)

- Result: 2 tokens identified

Final Selection:

- Token A: Gaming token, $2M market cap, 300 real holders, liquidity growing 10% daily

- Token B: DeFi protocol, $5M market cap, 500 real holders, accumulation phase

Outcome: Investing $1000 in each:

- Token A: 4x return in 3 weeks

- Token B: 2x return in 2 weeks

- Total return: $6000 from $2000 investment

This systematic approach removes emotion and focuses on data-driven decisions.

Integration with Overall Portfolio Strategy

Altcoin hunting should be just one part of your crypto portfolio:

Suggested Allocation:

- 40% Bitcoin/Ethereum (stability)

- 30% Large-cap altcoins (growth)

- 20% Mid-cap opportunities (higher growth)

- 10% Small-cap moonshots (found via DexScan)

Rebalancing Strategy:

- Take profits from moonshots into stablecoins

- Reinvest gains into BTC/ETH during corrections

- Maintain discipline about allocation percentages

- Compound wins, cut losses quickly

Tracking and Monitoring Your Positions

Once you've entered positions, use DexScan's watchlist feature:

- Add tokens to watchlist for quick monitoring

- Set custom alerts for price movements

- Track daily metrics for early exit signals

- Monitor liquidity changes for risk management

Exit Signals to Watch:

- Liquidity dropping >20% in 24 hours

- Holder count declining for 3+ days

- Buyer/Seller ratio below 0.8

- Large wallet movements (>5% of supply)

Conclusion: Data-Driven Altcoin Investing

Finding the best altcoins to invest in isn't about following influencer calls or chasing pumps, it's about systematic analysis of on-chain data that reveals real opportunity before the crowd arrives.

DexScan provides the metrics that matter:

- Real-time liquidity and holder data

- Smart money tracking capabilities

- Risk-adjusted return metrics

- Multi-chain opportunity scanning

The key to success is consistency: scan daily, track patterns, enter systematically, and manage risk ruthlessly. The tools are powerful, but discipline in applying them makes the difference between lucky gains and sustained profits.

Start with small positions as you learn the platform and refine your strategy. As you identify patterns that work for your style, scale carefully. Remember: in altcoin investing, surviving the losers matters more than maximizing the winners.

The next 100x token is being accumulated right now by smart money. With DexScan and this systematic approach, you can spot it before the masses and position yourself for life-changing gains.

Ready to find your next winning altcoin? Open DexScan, apply these filters, and let the data guide your decisions. The opportunities are there, you just need to know where to look.

Share this article

Help others discover this content

About the Author

Sharpe Team

The official Sharpe AI team bringing you insights on crypto, DeFi, and market analytics.

@SharpeLabs