Best Crypto Search Engine: Finding Data That Actually Matters

Find the best crypto search engine for blockchain research. Compare AI-powered tools, traditional databases, and discover what makes crypto search actually useful.

Best Crypto Search Engine: Finding Data That Actually Matters

Searching for crypto information shouldn't feel like archaeology. You ask a simple question - "which layer-2 networks have the lowest gas fees right now?" - and end up opening twelve tabs, cross-referencing three dashboards, and still not knowing if your data is current.

That's the problem most crypto researchers face. The information exists. Finding it quickly doesn't.

Why Regular Search Fails for Crypto Research

Google doesn't index the blockchain. Neither does Bing. When you search for token metrics, smart contract activity, or protocol fundamentals, traditional search engines show you:

- Blog posts from six months ago (stale data in fast-moving markets)

- Generic price charts without context

- Marketing pages instead of actual on-chain metrics

- No connection between related data points

The core issue: crypto data lives on-chain, not on web pages. Transaction volumes, wallet activity, liquidity pool changes, governance votes: these update every block. Regular search engines crawl websites. They miss the actual blockchain activity entirely.

Example: Search "Uniswap daily volume" on Google. You'll get articles about Uniswap. Search on a crypto-specific engine, you get the actual number from today's transactions.

The gap widens for complex queries. "Show me DeFi protocols on Arbitrum with >$100M TVL and token governance" requires connecting multiple data sources: chain data, protocol metrics, governance systems. Traditional search can't synthesize across these domains.

Metrics that matter:

- On-chain transaction counts (Google can't see this)

- Real-time liquidity depth (changes every block)

- Smart contract interactions (blockchain-native data)

- Cross-chain bridge volumes (requires multi-chain indexing)

What Makes a Crypto Search Engine Actually Useful

Not all crypto search tools solve the same problems. The best crypto search engine depends on what you're researching. Here's what actually matters:

1. Real-Time Data Integration

Crypto moves in minutes, not days. Useful search tools pull data directly from blockchain nodes or update frequently enough that you're not trading on yesterday's information.

Test: Search for a token's current price and compare it to a live DEX. If there's a 5-minute lag, that's a problem for active traders.

2. Natural Language Understanding

The difference between typing "ETH/USDC pool Uniswap V3 0.3% tier" (specific syntax required) and asking "what's the liquidity in the main ETH/USDC pool on Uniswap" (natural language).

AI-powered search engines understand context. You can ask follow-up questions. "What about the 0.05% tier?" The system remembers you're still talking about Uniswap ETH/USDC pools.

3. Multi-Source Synthesis

Good crypto research requires connecting:

- On-chain metrics (transaction volumes, unique wallets)

- Market data (prices, trading volumes, market cap)

- Protocol fundamentals (TVL, governance proposals, development activity)

- Social signals (community growth, developer engagement)

The best crypto search engine doesn't just aggregate this data, it synthesizes it. Ask "why did Protocol X's TVL drop 30% last week" and get an answer that connects on-chain outflows with a specific governance proposal and market conditions.

4. Blockchain-Specific Indexing

Tokens have multiple addresses (different chains). Protocols fork and rebrand. Liquidity migrates between versions. Traditional databases treat these as separate entries. Crypto search engines understand the relationships.

Example: Searching "USDC" should surface Circle's official USDC, bridged versions (USDC.e on Arbitrum), and related stablecoins (USDC on different L2s), with clear distinctions between them.

5. Query Result Transparency

Where is this data coming from? How recent is it? What's the data source?

Crypto search engines that show provenance (on-chain transaction, API source, last update time) build trust. Hidden sources or unexplained aggregations create doubt.

Red flags:

- No timestamp on data

- "Estimated" values without methodology

- Price data that doesn't match any major exchange

- Missing blockchain confirmations for on-chain claims

Best Crypto Search Engine Options Worth Trying

Here's what exists right now, stripped of marketing speak:

| Feature | Sharpe Search | CoinGecko | Messari |

|---|---|---|---|

| AI-powered search | Yes | No | Limited |

| Natural language queries | Yes | No | No |

| On-chain data integration | Yes | Basic | Advanced |

| Real-time updates | Yes | Yes | Yes |

| Free tier | Yes | Yes | Limited |

| Target user | Researchers/Traders | General | Professionals |

Evaluation Criteria

Speed: How fast do you get an answer to "which tokens launched this week with >$1M liquidity"?

Accuracy: Does the search understand "highest APY stablecoin farms" vs "highest TVL DeFi protocols"? These are different questions.

Coverage: Can you search across multiple chains (Ethereum, Arbitrum, Polygon, BSC) in one query?

Depth: Does "Bitcoin network activity" return just price, or also hash rate, transaction count, mempool size, and fee estimates?

How AI Changes Crypto Search

The difference between database search and AI search in crypto:

Database approach:

- Filter by chain → filter by protocol type → filter by TVL range → sort by APY

- Four steps minimum, assumes you know exactly what you're looking for

AI approach:

- "Show me high-yield opportunities on Ethereum with low impermanent loss risk"

- One query, system infers the filters and constraints

AI-powered crypto search engines parse intent. They know "high-yield" means APY matters, "low IL risk" suggests stablecoin or correlated asset pairs, and "Ethereum" narrows the chain scope.

Where AI helps most:

-

Pattern Recognition: "Which wallets bought tokens that later 10x'd?" requires analyzing thousands of wallet addresses and cross-referencing with token performance. AI spots the patterns.

-

Relationship Mapping: "What protocols does Vitalik's wallet interact with?" connects an address to protocols, extracts meaningful interactions (not just transfers), and infers significance.

-

Contextual Ranking: Search "best DeFi protocols" and get results ranked by your probable intent (trader vs researcher vs developer) based on query context.

-

Anomaly Detection: "Show me unusual whale activity" requires defining "unusual" relative to historical norms and current market conditions. AI handles the statistical analysis.

Limitations to know:

- AI can hallucinate if training data is incomplete

- Natural language ambiguity ("best" could mean safest, highest yield, most innovative)

- Requires larger computational resources than simple database queries

- Results depend heavily on data freshness and source quality

Where Most Search Advice Goes Wrong (and What to Do Instead)

Wrong: "Just use Google for crypto research"

Why it fails: Google indexes web content, not blockchain state. You'll find articles about crypto, not actual on-chain data. By the time information reaches a blog post indexed by Google, it's already outdated in crypto time.

What to do instead: Use blockchain-specific search tools that query node data directly. For price checks, go straight to DEX aggregators or on-chain data platforms. For protocol metrics, use tools that index smart contract events in real-time.

Wrong: "More data sources equals better research"

Why it fails: Five dashboards showing slightly different numbers creates confusion, not clarity. You spend more time reconciling discrepancies than analyzing the actual data. Information overload is noise, not signal.

What to do instead: Pick one or two high-quality sources with transparent methodologies. Understand how they calculate metrics. More important: look for tools that synthesize multiple sources and explain variances rather than displaying raw feeds.

Wrong: "Start with price charts for token research"

Why it fails: Price is a lagging indicator. By the time it moves, informed traders already acted on the fundamental changes. Starting with price means you're late to the insight.

What to do instead: Begin with on-chain fundamentals: wallet activity, smart contract interactions, liquidity changes, governance activity. Then check price to understand if the market already priced in these signals. This sequence helps you find mispriced opportunities.

Workflow example:

- Search on-chain metrics: "Protocol X daily active users last 30 days"

- Check fundamentals: "Protocol X TVL and fee revenue trends"

- Assess market reaction: "Protocol X token price vs fundamentals divergence"

- Decision: Is the market ahead of or behind the on-chain reality?

Wrong: "Manual research is more thorough than AI search"

Why it fails: Manual research has two big problems: human bias and time constraints. You can't check every protocol, every chain, every metric. You'll miss patterns that span hundreds of data points.

What to do instead: Use AI for pattern detection and anomaly spotting across large datasets. Apply human judgment to interpret results and make decisions. The best workflow combines AI's scale with human expertise.

Division of labor:

- AI: Scan 500 protocols for unusual TVL changes this week

- Human: Investigate the top 10 anomalies to understand why TVL moved

- AI: Find similar historical patterns and outcomes

- Human: Decide if current conditions match past patterns or represent new dynamics

Tools Worth Checking

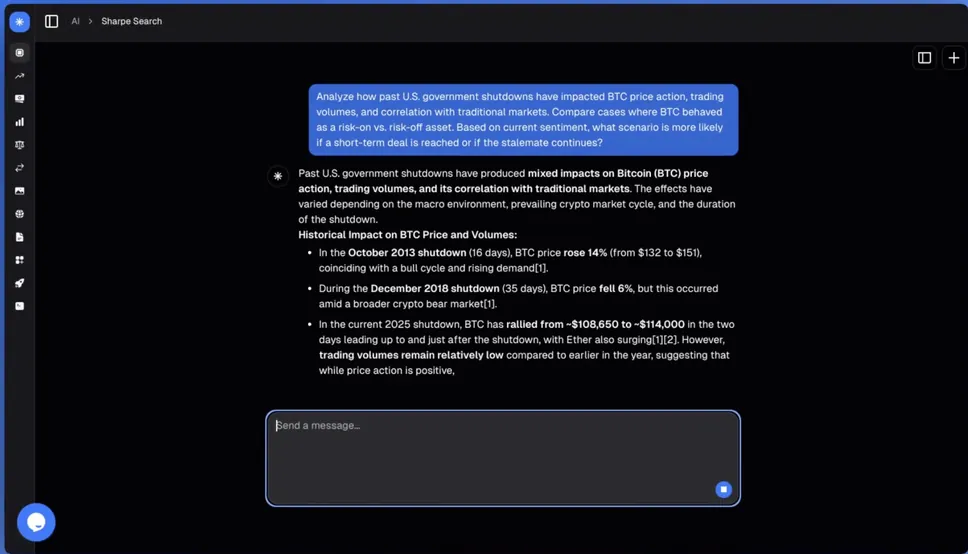

Sharpe Search

AI-based search engine that understands natural language crypto queries. Useful when you need to ask questions like "which DeFi protocols had the highest TVL growth last month" instead of manually filtering databases. Synthesizes data from multiple sources into direct answers. Good for researchers who want to ask questions the way they think about them, not the way databases are structured.

CoinGecko

Comprehensive cryptocurrency database with traditional search functionality. Good for basic token information, price tracking, and market cap rankings. Largest token coverage in the industry with data on thousands of coins across multiple chains. Free tier is generous. Works best when you know exactly which token you're looking for and want standardized metrics.

Messari

Professional-grade research platform with advanced filtering and analytics. Best for institutional research and in-depth protocol analysis. Provides detailed governance data, tokenomics breakdowns, and regulatory tracking. Requires subscription for full features, but the depth justifies the cost for serious researchers.

FAQ

What is a crypto search engine?

A crypto search engine is a specialized tool designed to search and retrieve blockchain-specific data like token prices, on-chain transactions, protocol metrics, and smart contract information. Unlike general search engines, crypto search engines index blockchain data directly and update in real-time as new blocks are added.

How does an AI crypto search engine work?

An AI crypto search engine uses natural language processing to understand queries like "which tokens have the most whale accumulation this week" and machine learning to synthesize answers from multiple data sources (on-chain analytics, market data, protocol fundamentals). The AI component maps your intent to relevant data points and presents synthesized results instead of raw database dumps.

What's the difference between a crypto search engine and CoinGecko?

CoinGecko is primarily a cryptocurrency database with search functionality: you look up specific tokens to see standardized metrics. A crypto search engine focuses on answering questions across multiple tokens, protocols, and chains without knowing exactly what you're looking for beforehand. Think "find me" vs "show me this specific thing."

Can I search for specific tokens using a crypto coin search engine?

Yes, crypto coin search engines support direct token lookups by name, symbol, or contract address. The advantage over basic databases is you can add context: "Ethereum tokens launched this month with >$5M market cap" returns a filtered list based on multiple criteria, not just a single token profile.

Do crypto search engines provide real-time data?

Most reputable crypto search engines update data frequently (every few minutes to every block), though exact freshness varies by metric type. Price data typically updates fastest (1-5 minutes), while more complex calculations like TVL might update hourly. Always check the timestamp on search results to confirm data recency.

Are crypto search engines free to use?

Many crypto search engines offer free tiers with basic functionality, including token lookups, price data, and simple queries. Advanced features like historical data analysis, complex filtering, API access, or institutional-grade analytics usually require paid subscriptions. The free tiers are often sufficient for casual research and trading decisions.

Which search engine crypto traders actually use?

Active crypto traders typically use a combination of tools rather than relying on a single search engine. Common workflow: specialized crypto search engines for discovery and research, on-chain analytics platforms for wallet tracking and smart money signals, and traditional exchanges or aggregators for execution. The "best" tool depends on trading style (day trading vs research-driven investing).

How accurate is AI-powered crypto search?

AI-powered crypto search accuracy depends on three factors: data source quality (are blockchain nodes reliable?), query interpretation (did the AI understand your intent?), and synthesis logic (does the answer actually address your question?). Reputable platforms show data sources and calculation methods, allowing you to verify results. Cross-check critical information, especially for high-stakes trading decisions.

Checklist: Evaluating Crypto Search Engines

Use this to test any crypto search platform before relying on it for research:

- Real-time test: Search for a popular token's current price. Compare to live DEX data. Gap should be <5 minutes.

- Natural language test: Ask "which protocols gained the most users last week" (or similar question requiring synthesis). Does it understand, or demand specific syntax?

- Multi-chain support: Search for a token that exists on multiple chains (like USDC). Does the tool distinguish between native and bridged versions?

- Data provenance: Check if search results show data sources and timestamps. If hidden, that's a red flag.

- Complex query test: Try "show me DeFi protocols on Arbitrum with >$100M TVL and governance tokens." Can it handle multiple filters?

- Update frequency: Note the timestamp on a result. Search again in 10 minutes. Did any data refresh?

- Historical access: Search for "Bitcoin price 6 months ago" or similar historical query. Can it retrieve past data or only current state?

- Mobile/API access: Check if the search engine works on mobile browsers or offers API access for programmatic queries.

- Free tier limits: Understand what's included in free vs paid tiers. Is the free version sufficient for your research needs?

- Cross-reference test: Pick a critical metric (like protocol TVL). Compare the search engine's result to the protocol's official dashboard. Should match within 2-3%.

Red flags to watch for:

- No visible data sources or timestamps

- Results that contradict official protocol data

- Queries that time out or fail frequently

- Forced account creation before seeing any results

- Price data that doesn't match major exchanges

Glossary

On-chain data: Information recorded directly on a blockchain (transactions, smart contract calls, wallet balances), as opposed to off-chain data like social media mentions or exchange API data.

TVL (Total Value Locked): The total dollar value of assets deposited in a DeFi protocol. Common metric for measuring protocol size and adoption.

Natural language processing (NLP): AI technique that enables computers to understand human language queries instead of requiring structured database syntax.

DEX (Decentralized Exchange): Trading platform built on smart contracts where users trade directly from their wallets without a centralized intermediary.

Impermanent loss (IL): The opportunity cost of providing liquidity to an AMM pool versus simply holding the tokens. Occurs when token price ratios change.

Layer 2 (L2): Blockchain built on top of Ethereum (or another L1) to increase transaction speed and reduce costs while inheriting the base layer's security.

Liquidity pool: Smart contract holding two or more tokens that enables automated trading via AMM algorithms. Users provide tokens and earn fees from trades.

Smart contract: Self-executing code on a blockchain that automatically enforces agreement terms without intermediaries.

Share this article

Help others discover this content

About the Author

Sharpe.ai Editorial

Editorial team at Sharpe.ai providing comprehensive guides and insights on cryptocurrency and blockchain technology.

@SharpeLabs